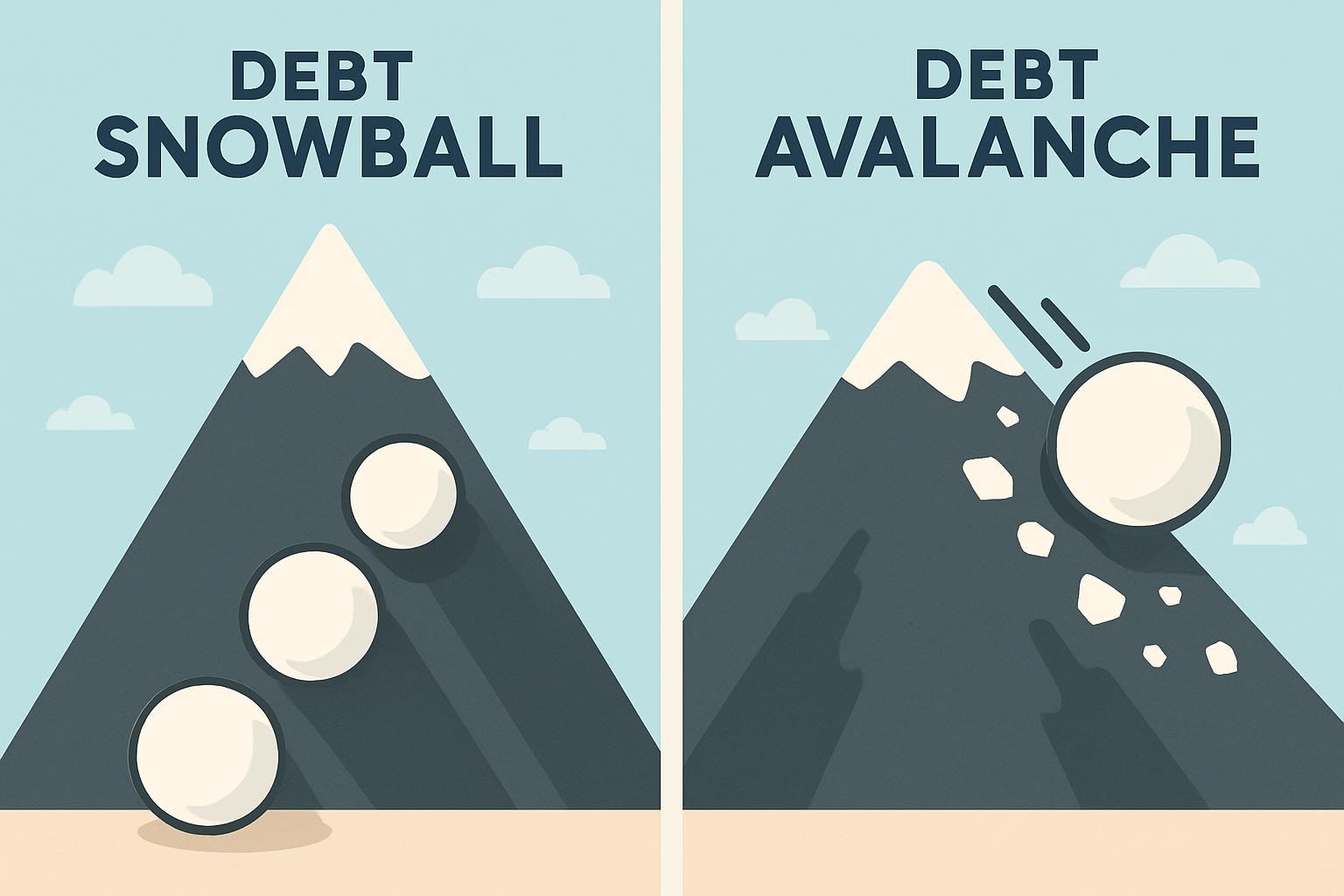

Debt Snowball vs Debt Avalanche Explained

Debt feels like that annoying background noise you can’t mute. Credit cards whisper, EMIs shout, and interest laughs at you every month. I’ve been there, staring at balances and wondering, “Why does my money disappear faster than free pizza at a party?” Sound familiar?

When people talk about debt payoff strategies, two names always pop up: Debt Snowball and Debt Avalanche. Both promise freedom, but they take very different routes. Which one actually works better? Which one keeps you motivated when life throws expenses at your face? Let’s talk it out—friend to friend—and figure out what fits you.

What Is the Debt Snowball Method?

Small Wins, Big Motivation

The Debt Snowball method focuses on paying off your smallest debt first, no matter the interest rate. You make minimum payments on everything else and throw extra cash at the smallest balance. When that one disappears, you roll its payment into the next smallest debt. Momentum builds fast.

I love this method for one simple reason: it feels good. Knocking out a debt quickly gives you that “I got this” energy. Ever noticed how one small win can flip your entire mood? Yeah, this method thrives on that psychology.

How the Debt Snowball Works

Here’s how you run the snowball, step by step:

- List all your debts from smallest to largest balance

- Ignore interest rates for now

- Pay minimums on all debts

- Attack the smallest debt aggressively

- Roll payments forward as each debt disappears

You keep repeating this process until debt stops haunting your dreams. 🙂

Why People Swear by the Debt Snowball

People don’t hype this method for no reason. It works because:

- You see progress fast

- Motivation stays high

- Consistency becomes easier

- You build confidence with every payoff

IMO, motivation beats math when emotions run the show—and debt always brings emotions.

What Is the Debt Avalanche Method?

Math Nerds, This One’s for You

The Debt Avalanche method flips the script. Instead of balances, you focus on interest rates. You attack the debt with the highest interest rate first, while paying minimums on the rest. This approach minimizes total interest paid over time.

I used this method during a phase when my brain screamed, “Stop wasting money on interest!” It felt logical, efficient, and very grown-up.

How the Debt Avalanche Works

The steps stay simple and clean:

- List debts from highest to lowest interest rate

- Pay minimums on everything

- Throw extra cash at the highest-interest debt

- Move down the list as each debt dies

This method doesn’t rush emotional wins. It plays the long game.

Why the Debt Avalanche Makes Sense

People love the avalanche because:

- You pay less interest overall

- You clear toxic high-interest debt first

- The strategy feels financially optimal

- You finish debt faster on paper

FYI, spreadsheets absolutely adore this method.

Debt Snowball vs Debt Avalanche: The Real Comparison

Motivation vs Math—Who Wins?

Here’s the honest truth: both methods work. The difference lies in how your brain reacts under pressure.

Let’s compare them side by side:

Debt Snowball

- Focus: Smallest balance first

- Strength: Motivation and momentum

- Best for: People who need quick wins

- Downside: You may pay more interest

Debt Avalanche

- Focus: Highest interest first

- Strength: Lower total interest paid

- Best for: Disciplined, numbers-driven folks

- Downside: Slower emotional progress

Ever quit a diet because results took too long? That’s exactly why some people struggle with the avalanche.

Which Method Feels Easier to Stick With?

Sticking with a plan matters more than choosing the “perfect” plan. I’ve watched friends quit the avalanche halfway because the biggest debt refused to shrink fast. I’ve also seen people stick to the snowball religiously because each payoff felt addictive.

Consistency beats optimization every single time.

Miss payments because you lost motivation? Both methods fail.

The Psychology Behind Debt Payoff (This Part Matters)

Why Emotions Control Money Decisions

Money decisions rarely follow logic. Stress, fear, and impatience drive most choices. The Debt Snowball method taps directly into human psychology by rewarding effort early.

When you eliminate a small debt:

- You feel lighter

- You feel capable

- You want to keep going

That emotional boost creates a positive feedback loop.

Why Logic Still Deserves Respect

The Debt Avalanche method respects numbers. High-interest debt drains your future faster than you realize. Every extra month costs you money you’ll never get back.

If you stay disciplined, the avalanche saves real cash. No hype—just math.

So ask yourself: Do I need motivation or structure right now?

Real-Life Example: Same Debts, Different Outcomes

Let’s Make This Real

Imagine this setup:

- Credit Card A: ₹20,000 at 36%

- Credit Card B: ₹50,000 at 18%

- Personal Loan: ₹1,00,000 at 12%

Debt Snowball Approach

- You attack ₹20,000 first

- You clear it quickly

- Motivation spikes

- Interest costs stay higher overall

Debt Avalanche Approach

- You attack 36% interest first anyway

- You save more on interest

- Progress feels slower initially

Same debts. Different emotional journeys. Which one would you actually finish?

Can You Combine Debt Snowball and Debt Avalanche?

Yes, and It Works Shockingly Well

You don’t need to pick sides like this is a sports rivalry. I often recommend a hybrid approach, especially for beginners.

Here’s how it works:

- Start with one small debt for a quick win

- Switch to highest interest debts afterward

- Keep motivation and math working together

This strategy keeps your brain happy and your wallet healthier. Not bad, right?

Common Mistakes People Make (Please Avoid These)

Mistake #1: Waiting for the “Perfect” Method

People waste months debating strategies instead of starting. Action beats perfection every time.

Mistake #2: Ignoring Emergency Savings

Always keep a small buffer. Life loves surprises, and debt plans collapse without backup.

Mistake #3: Adding New Debt Mid-Plan

I’ve seen this one too many times. New debt kills momentum instantly. Pause spending while you attack old balances.

:/ Yep, tough love—but necessary.

Which Method Should You Choose?

Ask Yourself These Questions

Answer honestly:

- Do I need quick motivation?

- Do I hate seeing many open debts?

- Can I stay disciplined without quick results?

- Does interest stress me out more than slow progress?

Choose Debt Snowball if:

- Motivation drives your behavior

- You feel overwhelmed by multiple debts

- You want fast visible wins

Choose Debt Avalanche if:

- You enjoy structure and logic

- You stay consistent long-term

- You want maximum savings on interest

No method wins universally. The best plan is the one you finish.

Final Thoughts: Just Start—Future You Will Thank You

Debt freedom doesn’t come from fancy spreadsheets or perfect strategies. It comes from showing up every month and staying consistent. Whether you roll a snowball or unleash an avalanche, you move forward—and that’s what matters.

I’ve used both methods at different times in my life. I don’t regret either. I regret only the months I waited, overthinking instead of acting.

So pick a method, commit, and start today. One year from now, you’ll look back and think, “Wow, I really did that.” And trust me—that feeling beats any interest calculation 😉

Ready to choose your weapon and fight back against debt?