Budgeting for Beginners: Step-by-Step Guide

Let me guess—you want to manage your money better, but every time you hear the word budget, your brain goes, “Yeah… maybe tomorrow.” 😅

Been there. I used to think budgeting meant spreadsheets, calculators, and zero fun. Spoiler alert: it doesn’t. Budgeting is just a plan for your money, not a punishment.

So grab a coffee, sit back, and let’s talk about budgeting like normal humans. No finance degree required. IMO, this is stuff everyone should’ve learned in school—but hey, better late than broke, right?

Why Budgeting Isn’t as Boring as It Sounds

Budgeting gets a bad rep, and honestly, I blame those ultra-serious finance gurus. Budgeting doesn’t mean you stop living. Budgeting means you tell your money where to go instead of wondering where it went.

Ever checked your bank balance and thought, “Wait… how did this happen?”

Yeah, that’s exactly why budgeting exists.

When you budget:

- You feel more in control

- You stress less about bills

- You actually save money without trying too hard

And no, you don’t need to give up coffee. Relax.

Step 1: Know Your “Why” Before Anything Else

Before numbers, apps, or categories, ask yourself one thing: Why do I want to budget?

Seriously—this matters more than you think.

Maybe you want to:

- Get out of debt (credit cards are sneaky like that)

- Save for a trip, wedding, or emergency fund

- Stop living paycheck to paycheck

- Feel like an adult who has their life together (relatable)

Your “why” keeps you motivated when budgeting feels annoying. And yes, it will feel annoying sometimes. That’s normal.

Step 2: Figure Out Your Real Monthly Income

Now let’s talk money. Start with how much you actually earn, not what you wish you earned.

What to include:

- Salary (after tax, please)

- Freelance or side hustle income

- Any regular extra income

What to skip:

- One-time bonuses

- Random gifts

- “Maybe I’ll earn this” money

Use your lowest consistent income number. This keeps your budget realistic instead of fantasy-based.

Ever planned spending around money you didn’t earn yet? Yeah… don’t do that.

Step 3: Track Your Expenses (Yes, All of Them)

This part feels uncomfortable, but it’s eye-opening. You need to know where your money currently goes before you fix anything.

Track at least one full month of expenses.

Categories to look at:

- Rent or mortgage

- Utilities

- Groceries

- Eating out

- Transportation

- Subscriptions (hello, forgotten Netflix)

- Shopping

- Random stuff you don’t remember buying

FYI, this step alone changed my money habits. Seeing numbers in black and white hits different.

Step 4: Separate Needs vs Wants (No Judgment Here)

Let’s clear something up: wants aren’t bad. Life should be fun. The issue starts when wants eat up all your money.

Needs usually include:

- Housing

- Food

- Utilities

- Transportation

- Basic insurance

Wants usually include:

- Eating out

- Shopping

- Entertainment

- Subscriptions

- Impulse buys at 2 a.m.

The goal isn’t to delete all wants. The goal is balance.

Ask yourself: Does this expense improve my life, or just my mood for five minutes?

Step 5: Choose a Budgeting Method That Fits You

There’s no “one-size-fits-all” budget. Anyone who says otherwise probably enjoys pain.

Popular budgeting methods:

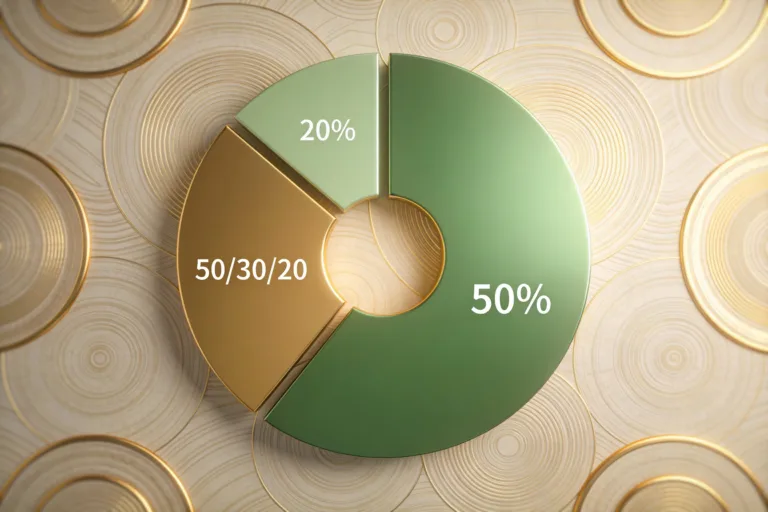

1. 50/30/20 Budget

- 50% needs

- 30% wants

- 20% savings or debt

This works great if your income stays steady.

2. Zero-Based Budget

- Every dollar gets a job

- Income minus expenses equals zero

This sounds intense, but it gives you maximum control.

3. Pay Yourself First

- Save first

- Spend what’s left

Simple and effective if you struggle to save.

IMO, the best budget is the one you’ll actually stick to. Fancy systems don’t matter if you quit after a week.

Step 6: Set Simple, Realistic Money Goals

Goals make budgeting feel worth it. Without goals, budgeting feels like eating plain oatmeal forever.

Good beginner goals:

- Save ₹10,000 as an emergency fund

- Pay off one small debt

- Save for a short trip

- Stop overdraft fees (those hurt)

Make goals specific and achievable. “Save more money” sounds nice but means nothing.

Ask yourself: What would make my life less stressful right now?

Step 7: Automate What You Can (Lazy Wins)

Automation is your secret weapon. If you rely on motivation alone, budgeting will fail. Trust me.

Automate:

- Savings transfers

- Bill payments

- Loan EMIs

When money moves automatically, you don’t overthink it. You also don’t “accidentally” spend it.

Lazy budgeting is smart budgeting 🙂

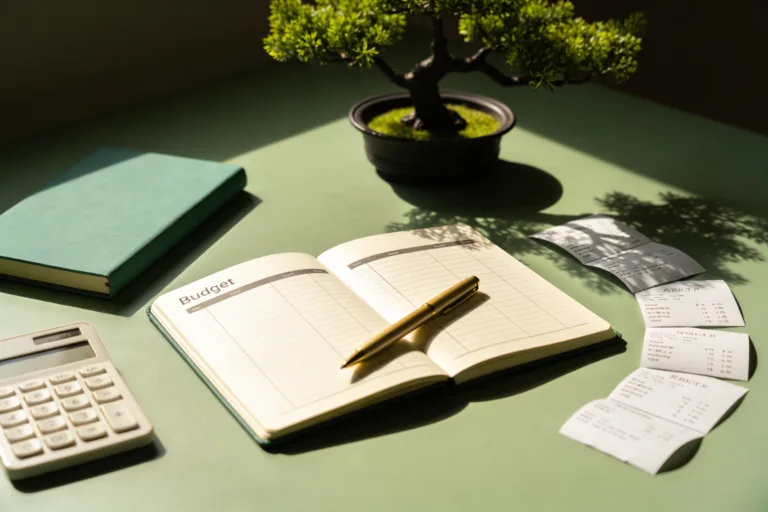

Step 8: Use Tools, But Don’t Overcomplicate It

Apps can help, but they’re not magic. A budget works because you use it, not because it looks pretty.

You can use:

- Budgeting apps

- Excel or Google Sheets

- A notebook (old-school, but effective)

Start simple. If tracking feels overwhelming, you’ll quit. And quitting helps no one.

Ever downloaded five apps and used none? Same.

Step 9: Expect Mistakes (They Don’t Mean Failure)

You will overspend sometimes. You will forget categories. You will mess up.

That’s normal.

Budgeting is a skill, not a personality trait. You get better with practice.

When things go wrong:

- Adjust your budget

- Learn from it

- Move on

Beating yourself up doesn’t save money. Fixing habits does.

Step 10: Review and Adjust Every Month

Life changes. Your budget should too.

At the end of each month:

- Check what worked

- See where you overspent

- Adjust categories

This takes 15–20 minutes and saves you hours of stress later.

Ask yourself: Did this budget make my life easier?

Common Budgeting Myths (Let’s Bust Them)

Let’s quickly clear up some nonsense.

- “I don’t earn enough to budget.”

Wrong. Budgeting helps most when money feels tight. - “Budgeting kills fun.”

Nope. It actually lets you enjoy fun without guilt. - “I need to be good at math.”

If you can subtract, you’re good.

Budgeting isn’t about restriction. It’s about intention.

Final Thoughts: Start Small, Stay Consistent

If you take one thing from this guide, let it be this: budgeting works when you keep it simple and realistic.

You don’t need perfection. You need consistency.

Start messy. Adjust often. Laugh at mistakes. Celebrate progress—even small wins.

So… are you ready to tell your money who’s boss, or will you let it keep ghosting you every month? 😉

Either way, start today. Your future self will seriously thank you.